Client Bill of Rights

The Essential Questions You Should Ask ANY Financial Advisor (Even if You’re ALREADY a Client)

Evaluating financial advisors isn’t easy.

“Do I need a fiduciary?”

“Do I need an advisor or a planner? Or both?”

“How much is it going to cost me?”

The questions can seem endless, and that leads to paralysis.

If you’ve wondered:

“Am I getting the right kind of advice?” or

“I’ve got questions but I’m not getting the answers I need,” you’re in the right place.

This quick guide outlines your “Client Bill of Rights” and teaches you the essential questions you should ask ANY advisor to determine whether they deserve your trust.

Client Right #1

I have the right to competent advice that puts my needs first

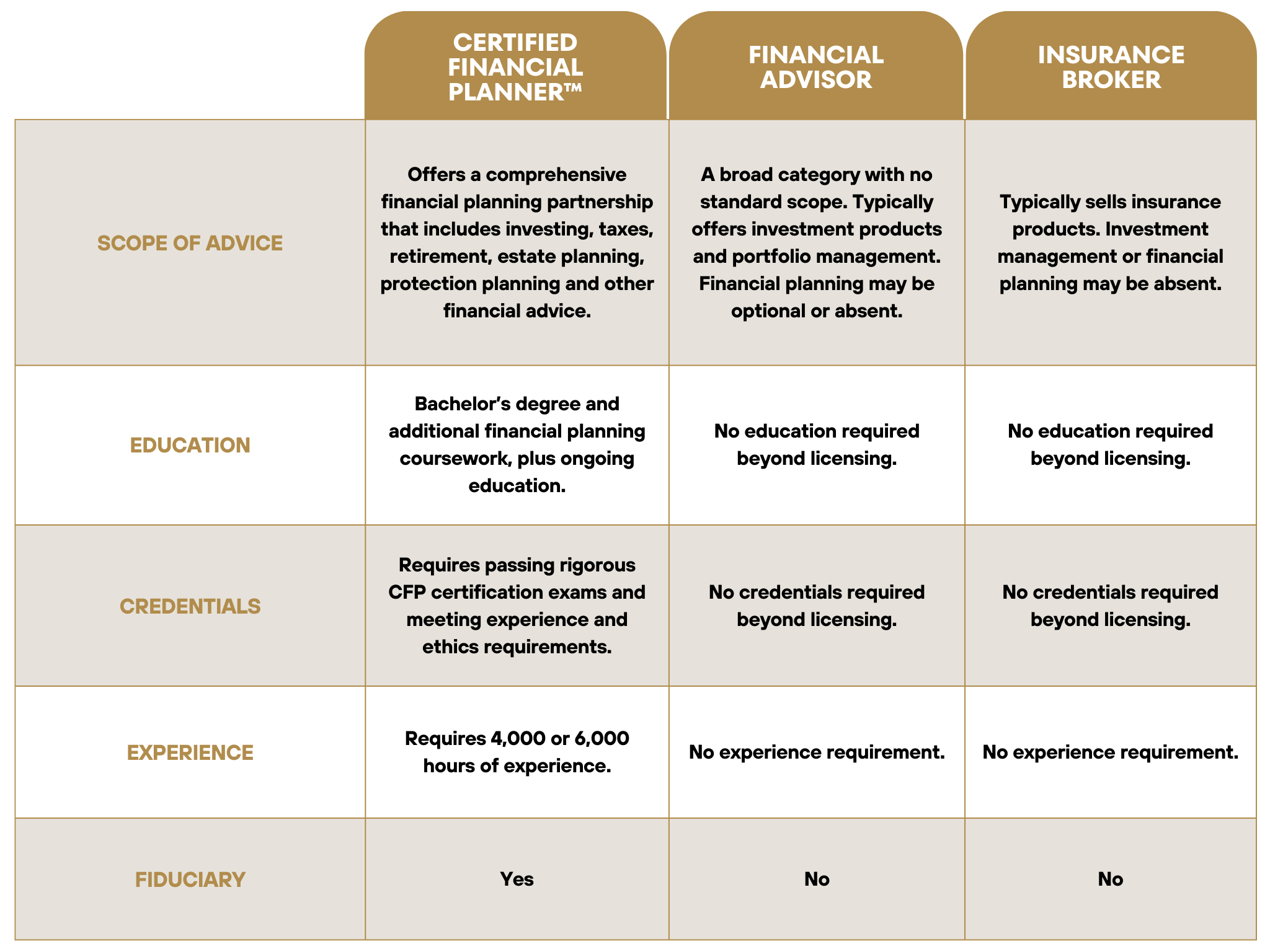

The financial advice industry is confusing and full of titles and credentials, making it difficult to assess an advisor’s competence or the scope of their services.

Here’s a quick tool you can use to review skills and experience.

Client Right #2

I have the right to ask questions and get answers I understand

Whether you’re currently working with an advisor or you’re new to the world of professional advice, you have the inalienable right to ask questions and get answers that you understand at every stage of your advisory relationship.

Here are a few questions you should be asking:

Are you a fiduciary?

What are your qualifications?

What kind of clients do you typically work with?

What’s your scope of advice?

What’s your philosophy around investing and financial planning?

Do you offer a full financial plan?

What services don’t you offer? Why not?

If I need a service you don’t offer, what do I do?

Who will I be working with if I become a client?

Can you repeat that so I can understand it?

Client Right #3

I have the right to know how my advisor gets paid

Do you know how your advisor gets paid? Every professional deserves to be paid for their work, but there are several ways financial advisors can be paid.

Each has pros and cons. What’s important is understanding how your advisor gets paid and how this affects the advice they offer.

Here are some questions you can ask your advisor to understand how their fees work:

How do you get paid?

Do you receive any commissions or fees from the products you sell?

How do your fees affect the advice you give me?

What are my all-in costs for a year for the services you recommend?

Client Right #4

I have the right to an advisor partnership that meets my “chemistry test”

Everyone has preferences, and you deserve to work with an advisor who has great rapport and a shared philosophy.

One way to help you decide whether you and an advisor are compatible is to come up with your own version of a personal “chemistry test.”

Here are some questions to get you started:

What values are important to you?

How do you educate your clients?

How and how often do you communicate with your clients?

How often will we meet 1-on-1?

What kind of relationship do you want to have with your clients?

When you’ve met with an advisor, it can help to take a few minutes and ask yourself some questions:

Did the advisor make me feel comfortable?

Did they take the time to answer my questions?

Did they give me full and open answers, or were they vague?

What kind of impression did the advisor give me?

Client Right #5

I have the right to change advisors when they no longer fit my needs

It’s okay to want to find a new advisor. Sometimes, an advisor that was helpful for years just doesn’t have the skills or ability to help you through a transition like retirement or major life change.

Maybe they’re just not communicating effectively or the “chemistry” just isn’t there anymore.

If you’re experiencing any of the following, you may have a “bad fit advisor.”

• You dread calling or emailing (what would it change, anyway?)

• You have this nagging feeling that you want something different

• They seem competent, but you don’t feel heard or understood

• They aren’t communicating or meeting with you as often as you’d like

You deserve an advice relationship that fits your current (and future) needs.

Here are some questions you should ask yourself to gauge whether it’s time to move on:

1. Does my advisor specialize in helping people handle my specific issue?

2. Does my advisor answer my questions openly in ways I can understand?

3. Do they communicate with me in the ways I prefer?

4. Do I feel like a priority or a number?

5. Do I walk away from meetings feeling empowered or frustrated?

If a lot of your answers are negative, it’s probably time to move on.

You Deserve Financial Advice That Fits Your Needs

There are a lot of different types of advisors out there. We believe that a planning-first approach is the optimal way to achieve your financial goals.

As Certified Financial Planners™ our goal is to develop a long-term partnership with our clients and become their go-to for financial advice.

We believe that you deserve competence, skills, education, and advice that puts your needs first.

We can’t promise that we are the right firm for you because we can’t help everyone.

However, we strongly believe that the best way to decide is for us to have a quick conversation and begin answering some of the questions above.

If you’re ready to take an easy next step, just click the button below and let’s find a time to chat.

Spend time where it matters.

Are you ready to simplify your financial journey?